Why review your Medicare plan? Some insurance companies plan to raise monthly premiums in 2015 and that’s one big reason for you to take a look.

Sure it’s a pain in the neck and you’d probably rather ignore the “Annual Notice of Changes,” and the stack of information, you get in the mail. But you may save money and get a better deal if you compare your current plan with a plan offered by another insurer.

There’s also the possibility that your plan will raise rates and another plan will not.

There’s also the possibility that your plan will raise rates and another plan will not.

My insurer, for example, sent notification that the Part D, prescription drug premium, is going up from $44.30 a month to $52.10 a month. That won’t kill me. But it will make me look around to see what else is out there.

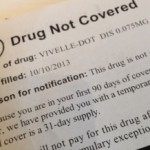

It’s also a good idea to review the medications the insurer plans to cover in 2015.

They may drop your medication and that’s a pretty good reason to seek out another company. The booklet they send you announcing changes should include the “formulary.” That’s what insurers call their list of covered medications.

It may contain only a partial list, so it’s wise to follow the instructions they offer and try to communicate with a representative to find out if the plan includes what you need for 2015.

We provide tips to figure out the key things to consider in your Part D plan in ConsumerMojo’s post Why Change Your Medicare Part D Plan?

Medicare sets aside an Open Enrollment every year from October 15 to December 7th. This gives you a chance to examine the material, make comparisons and make a change.

You generally don’t have to do anything if you want to continue your plan. But if you think you can get a better deal with a different insurer, you must make the change by December 7th.