While Donald Trump ran as the champion of the working man and woman, his administration appears ready to gut the bureau that protects Americans from financial predators. A report from the Treasury Department says the Consumer Financial Protection Bureau (CFPB) over-reached and should have its authority reduced.

This is the same agency that in recent days urged retailers to make their credit card policies more transparent. The bureau found that retail store credit card promotions that defer payment often result in consumers paying more because they don’t understand the deadlines and penalties involved.

You may remember that the CFPB also exposed how Wells Fargo employees falsely opened credit card accounts for 1.5 million consumers, and was forced to pay restitution and fines totaling $175 million.

The bureau also regularly goes after banks like J.P. Morgan Chase for illegal credit card practices, and that brought a $309 million fine. It also took action against Chase for allegedly charging African Americans and Hispanics more for their mortgages. The bank didn’t admit guilt, but paid a fine and restitution of $55 million. Chase was also fined $50 million for illegal debt collection practices.

It ordered Citibank to pay $770 million for illegal credit card practices. It also ordered Citibank to pay $28.8 million for failing to provide clear information to consumers struggling to save their homes from foreclosure, and another $8 million for debt collection fraud.

The list of CFPB action against Chase, Citibank, Wells Fargo and other big financial institutions goes on. The bureau came to life as part of the Dodd-Frank reforms after bad banking practices caused the 2008 financial crisis.

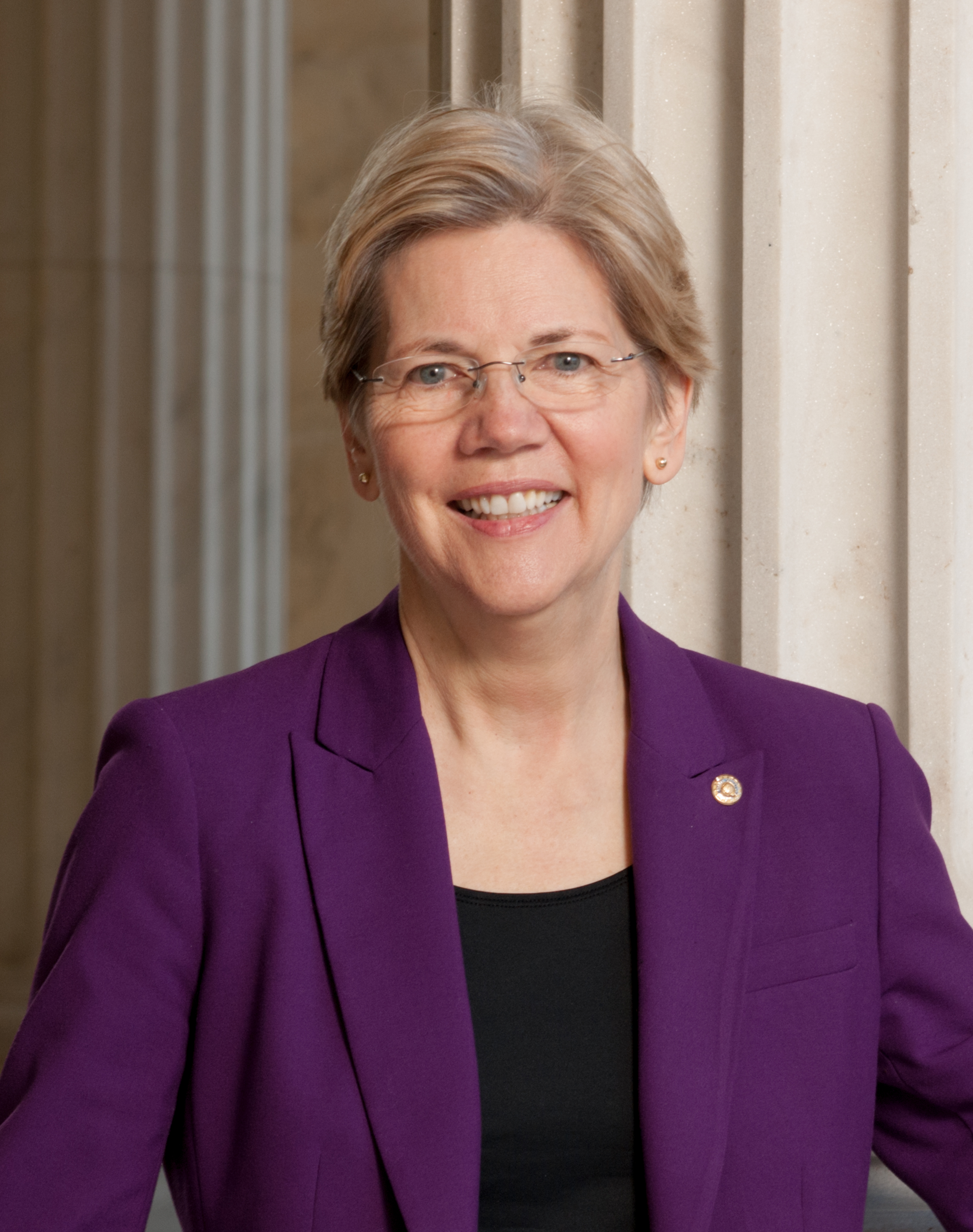

Massachusetts Senator Elizabeth Warren advocated early on for the establishment of a government financial watchdog. After the Treasury issued its report she called the recommendations to weaken the CFPB “radical” and said, “it would make it easier for big banks to cheat their consumers and spark another financial meltdown.”

Since its creation, the CFPB has gone after big banks repeatedly for dishonest practices. It has advocated for reform of student loan and debt collection. It has tried to stop predatory lending and filed legal action against debt collectors who harass and intimidate consumers even when they don’t owe any money.

The lengthy catalog of accomplishments, on behalf of American consumers, theoretically should make those who govern feel good about themselves. The bureau’s work retrieved $11.8 billion dollars in fines and payback for more than 29 million consumers.

So why get rid of it? Well, the big bankers don’t like it. The lobbyists and the people in the Trump Administration, who don’t have consumers’ interests on their agenda, include Treasury Secretary Steven Mnuchin.

Just take a look at his background. The former Goldman Sachs banker bought IndyMac, a failed mortgage lender, during the financial crisis. He changed the name to OneWest and aggressively foreclosed on homeowners in arrears and earned the nickname the “foreclosure king.”

Now the Treasury report, under his name, oddly says, “The CFPB’s structure renders it unaccountable to the American people.” The report criticizes the CFPB for what it calls “over reaching” and attempting to get auto dealers, college lenders and servicing agencies and others on the fringes of lending and banking to stop predatory practices and help consumers.

So the Treasury Department wants to put the brakes on the CFPB, restructure it to weaken the power of the director and appoint a commission to oversee its work.

If you disagree with gutting the CFPB, contact your U. S. senator and representative and let them know what you think.

Here’s where to find your representative: http://www.house.gov/htbin/findrep

Here’s where to find your senator:

https://www.senate.gov/senators/contact/