Our video, with experts from the Medicare Rights Center and Center for Medicare Advocacy, explains what you need to know about the Open Enrollment period. This is an important time to to take advantage of the opportunity to change your Part D plan.

The open enrollment period began on October 15th and runs until December 7. So now is the time to consider a change to your Medicare Part D plan. You might want to choose another plan with your current insurer, or even choose another. Why should you?

Good question.

WHY CHANGE YOUR DRUG PLAN?

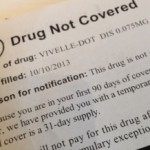

Your insurer may not list your drug on its “formulary.” The “formulary,” is what the insurer calls its list of approved drugs.

Every insurer has a variety of plans, and each plan has it’s own list of approved drugs. It’s maddening that there is not a uniform policy. But this is the way it is.

So even if you have a happy relationship with your insurer, they may have changed things up on you. It’s really important to check your mail. If you received a notice that said something about important changes, open it.

Don’t dump it on the pile of mail.

It’s likely that there is something in the notice that tells you the insurer has added approved drugs, or removed others. Check to see if your medication is on either list

Tip 1

- Make a list of your prescription drugs

- Match your list to what the plans offer

Tip 2

Check to see how your insurer categorizes your drug in its tier system.

The tier system is a complicated way of explaining that you’ll pay more for certain drugs.

Tier 1 drugs are cheaper, than Tier 2. Tier 3 drugs are more expensive than Tier 1 and Tier 2. And Tier 4 will cost you the most.

Tip 3

Read the rules the insurer outlines. It’s essential to know whether the company will require you to get prior approval or require you to use a generic drug for a test period called “Step Therapy.” In “Step Therapy,” it will require you to use a generic drug or several generic drugs before it approves a brand-name drug for payment.

Or, the insurer may limit the quantity of medication that you can get. It’s important to look at these rules because they can cost you money and make your life hellish if you don’t understand the benefits and the limitations.

- Prior approval

- Step Therapy

- Quantity Limits

![]() Medicare Basics for Boomers and Everyone Else

Medicare Basics for Boomers and Everyone Else

![]() Medicare Part B, Boomers and Costly Mistakes

Medicare Part B, Boomers and Costly Mistakes

![]() Choosing Power of Attorney Tips

Choosing Power of Attorney Tips

LIKE OUR POSTS AND COMMENT PLEASE!