Barbara Nevins Taylor

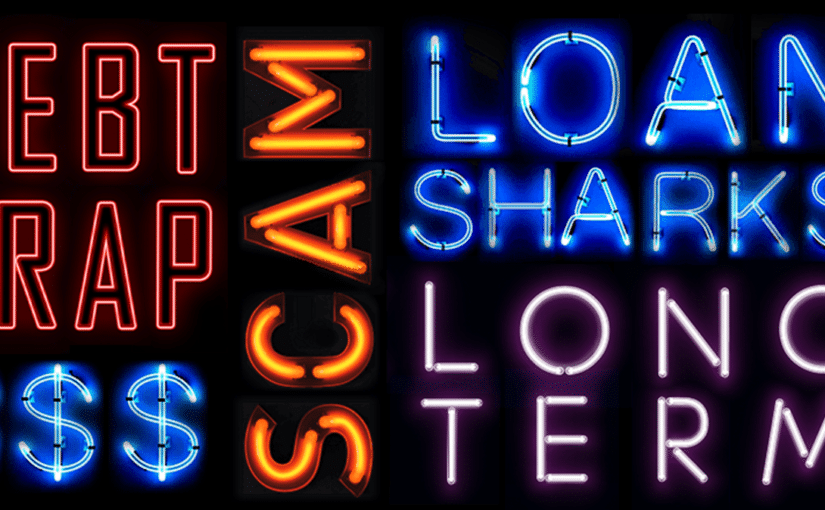

If payday lending makes you angry, if you’ve seen someone hurt by this kind of predatory lending, or if you became a victim because you needed money to pay a bill, now is the time to speak up and speak out.

The Consumer Financial Protection Bureau (CFPB) will make new rules to regulate this wildcat industry and they want to hear from real people.

Payday lenders typically lend some amounts of money at interest rates that often climb to 300 percent. When a borrower has trouble repaying they may renew the loan and add fees and interest on the interest. So these loans become a no-win situation.

The Center for Responsible Lending issued a rallying cry and set up a way for you to let the CFPB know what you think.

Here’s what they say:

“These are the final days to let the Consumer Financial Protection Bureau (CFPB) know what you think about proposed rules that, if strengthened, could rein in the worst abuses of payday and car-title lending.

The proposed rules are based on the ability-to-repay principle – the common-sense idea that if lenders make loans, they must ensure the borrower can repay those loans without re-borrowing or defaulting on expenses. The problem is that there are exceptions within CFPB’s proposed rules, loopholes the payday lenders can wiggle through, which they have shown themselves so good at doing over the years.

Time is running out to make our voices heard. So act now to add your voice! Tell the CFPB: don’t give payday lenders room to wiggle around the ability-to-repay requirements!”

Add your comment BY FRIDAY to stop the debt trap!

Sarah Ludwig of The New Economy Project, formerly NEDAP, an advocacy group that helps people who fall victim to financial scams, made this video for us about the dangers of taking a payday loan.