By Christine Alexis

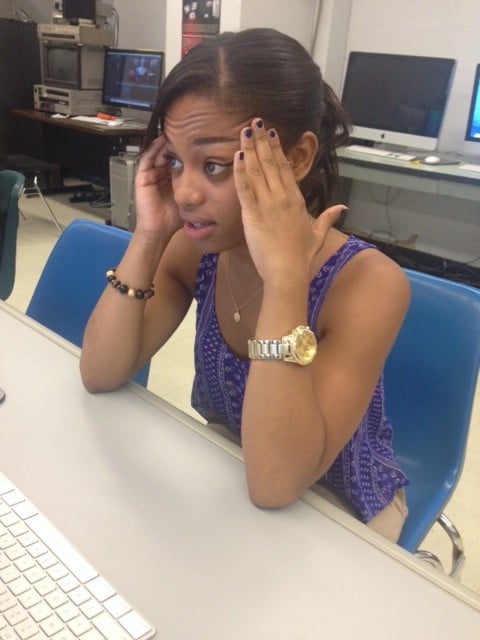

My photo is funny, but my situation is not. After listening to President Obama talk about student loan debt, I decided to look into my own situation. It’s been about two weeks since graduation. And I expected my loan servicer to knock on my door immediately about my student loans. But no one did.

The last time I received any notice about my student loans was in October 2013. FedLoan Servicing notified me that they paid my tuition. They wrote, “As of today, your current principal balance for the loans we service is $16,106.00.” So that’s what I thought I owed.

Instead, I was shocked to sign into my student loan account after the President’s speech and see that my total loan balance was now at $21,506 with $488.56 in unpaid interest charges.

Let’s put this into perspective.

$21, 506 + $488.56 = $21,994.56

This translates to $1,099.72/yr. over 20 years at $91.64 per month.

Two things jumped out at me. My first question is, why didn’t I know about this sooner? If my loan servicer contacted me sooner or someone had really explained this to me, I would’ve taken steps to pay off my interest charges while I was in school.

My second question is, what do I do now? Obviously I have to pay this off. But what’s the best way to go about it? Small monthly payments to get rid of interest charges first, or begin paying off the entire debt?

I work part time as a waitress. With a very small flow of money coming in every week, I’m worried that I will not be able to make significant monthly payments. The bottom line is, I just graduated and I’m facing my student debt and I’m worried about how this will effect my future.

ConsumerMojo looked into the Consumer Financial Protection Bureau’s investigation of loan servicers. The CFBP is a watchdog agency that works to get consumers the information they need to make the financial decisions they believe are best for themselves.

President Obama’s executive order, linking monthly payments to your salary, won’t go into effect until December 2015. In the coming weeks, I will be searching for answers about how to take control of your student loan debt now as I begin to take control of my own and writing about it here. If you have any ideas or resourceful tips, please comment below and share!

The More you can pay of in the shortest amount of time means less interest in the long run. . . also look for any loan forgiveness programs that might be available for your particular major/ career path. It comes down to discipline and delaying gratification for a little bit longer in order to save as much as possible in interest payments.

There are definitely flaws to the notification system affiliated with student loans, specifically. I’ll owe over twice as much money as your current debt (excluding interest) and I rarely ever hear from my loan service provider. Our generation is going to drown at this rate unless something drastic takes place at the federal level.

I loved your post and it sparked me from coming out of the shadows all the way from elementary lol i can’t tell you the exact way to eliminate your debt because i have just as much, but maybe if i showed you my mentality on how to tackle it, that might help.

One of the first things i think might help is aiming to pay off the unsubsidized loans first because those are the ones that accumulate interest. And subsidized loans you should hold off on until later because that amount stays flat. The average $ amount you can take out on loans annually is about $13,000, $37,000 by undergrad (estimated). In these final couple of semesters, if you can,apply for grants or even scholarships, it seems much better being able to pay off debt with free money.

Lastly, being that i moved from new York, i have car payments and rent to worry about but if you plan on remaining in the city, I’d say to prolong car payments/ mortgage until you can clear some of that debt.

One last couple of ideas that might help is to sell anything that you might not need that can be of value (i sold my basketball hoop, old car, Jordans collection lol) and keep it in a savings account so that it can build interest which you can use in the future to pay off those loans