by Barbara Nevins Taylor

I’m relatively new to Medicare Part B and when I chose an insurer I made assumptions about its drug plan. That was my mistake.

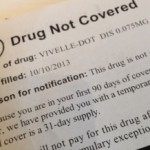

I automatically assumed that the only medication I use, an estrogen replacement called the Vivelle-dot, would be covered under the drug plan. Bad assumption. It was not covered.

The first time I used the plan, insurance paid for part of the prescription. Soon after, I received a letter and a notice that explained while the drug wasn’t covered under my plan, the insurer provided courtesy coverage because I’d been in the plan less than 90 days.

The insurer didn’t offer alternatives, but suggested that I choose another medication.

This set me on a time-consuming, frustrating search. The company’s list of approved drugs for the particular Medicare Advantage plan I had didn’t turn up anything that I can use.

I realized that I’d have to take advantage of the Open Enrollment period and switch to a Medicare Supplemental or Medi-gap plan and purchase a separate Part D plan to get what I wanted.

I reviewed other insurers’ plans, and looked at those that my current insurer offered. Despite the fact that I’ve researched and written about Medicare, it was incredibly confusing when it came to taking care of myself.

The information from the insurer’s customer service and sales people conflicted with the information on the website. I wasted hours trying to get this right.

A GOVERNMENT WEBSITE THAT WORKS

Then I went back to basics and found the easiest way to compare insurance companies, their drug costs and their plan.

It’s right there in plain sight on a government website that works: MEDICARE.GOV.

Here’s what to do.

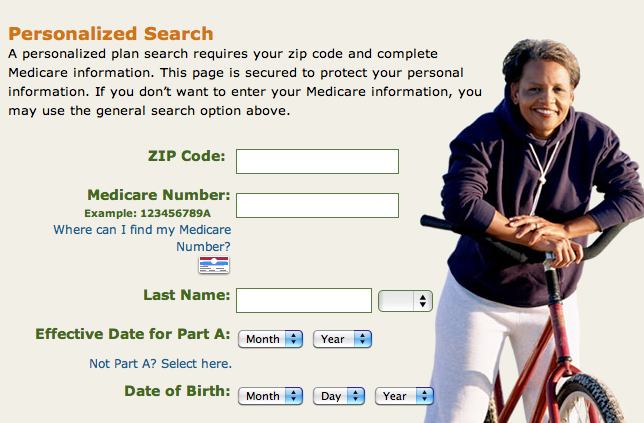

1. Go to Medicare.gov

2. On the home page click on FIND HEALTH AND DRUG PLANS

3. On the second page fill out the personal section. It’s easier and quicker than the generic.

4. On the third page fill in the information about the drug you want. You get results quickly. A new screen shows a comparison of insurers’ plans, the drugs they offer, the prices and Medicare’s rating of the drug plans.

I found my medication listed in a Part D prescription drug plan offered by my insurer, UnitedHealthcare. The insurer and its Part D plan received a good rating from Medicare and that made me feel comfortable about my decision. Switching to a Medicare Supplemental plan, or Medi-gap, also gives me a wider choice of doctors and healthcare providers. So it was a win, win situation.

APPLAUSE FOR MEDICARE.gov

The look-up process is so easy that I kicked myself for not using this handy tool sooner.

There is one more thing. Because I pushed the insurer, they put me in touch with a local broker named Rae-Carole Fischer. She was incredibly patient and went over all of the choices with me again, made sure that I had the right paperwork and submitted it for me.

Finding a local insurance broker to help you is also a good way to confirm your decisions.

Insurance companies pay the brokers or agents according to a fee schedule set by the Centers for Medicare and Medicaid Services. Brokers must be licensed by the states where they work and before you deal with one, make sure they are licensed and have affiliations with the companies that they say they represent.

![]() 3Tips for Choosing a Medicare Plan D

3Tips for Choosing a Medicare Plan D