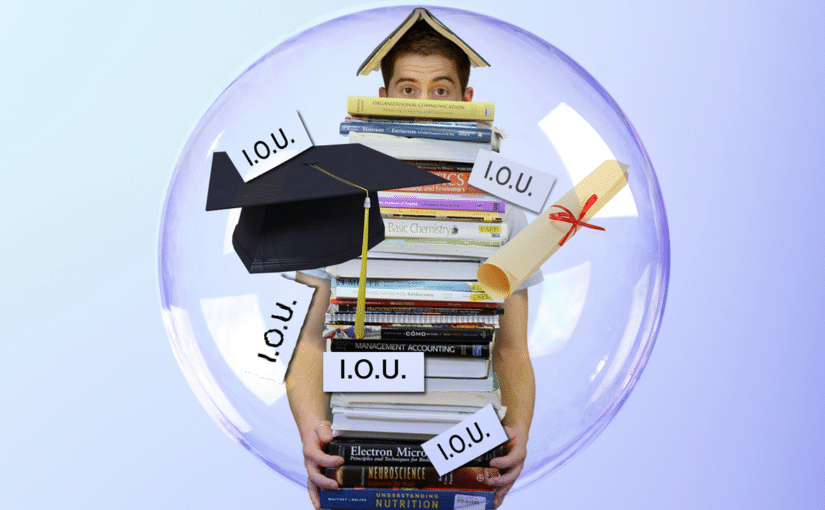

You invest in an education and then hope to reap the benefits. In America, traditionally, you graduate from college or grad school, enter a profession, make money, maybe marry or partner-up and buy a home. But the paradigm seems to have changed, at least for the current crop of twenty-five to thirty-year olds.

Home buying appears choked by student debt, according to the latest analysis by the Federal Reserve Bank of New York. Its 2014 Household Debt and & Credit Report found student loan debt increased $31 billion in the first quarter of the year.

That’s pretty serious because it brings the overall student debt to more than $1.11 trillion and affects a huge group of people. 69 percent of twenty-five-year-olds who took student loans are now in debt for, on average, about $20,926.

It may not be a staggering number, for some. But it’s big enough to make starting out in the game of life tough. Carrying this kind of debt hurts buying power and stifles the ability to invest in a home.

In 2013, the Fed discovered the same pattern it first identified in 2012. Young people who didn’t go college were more likely to buy a home than those who graduated from college. College grads were either worried about taking on new debt, or their credit wasn’t strong enough to get a mortgage, or we’re seeing a shift in cultural values.The analysts aren’t ready to identify a reason.

Auto buying is the one bright spot for young people. Previous reports from the Fed said they were putting off buying cars or vehicles because of their debt problems. That seems to have changed slightly in 2013. Twenty-five year olds, who are paying off student loans, are now borrowing to buy cars, but not in the numbers that they once did.

The latest news provides more evidence that there’s an urgent need to reform student loan borrowing, interest rates and the repayment process.