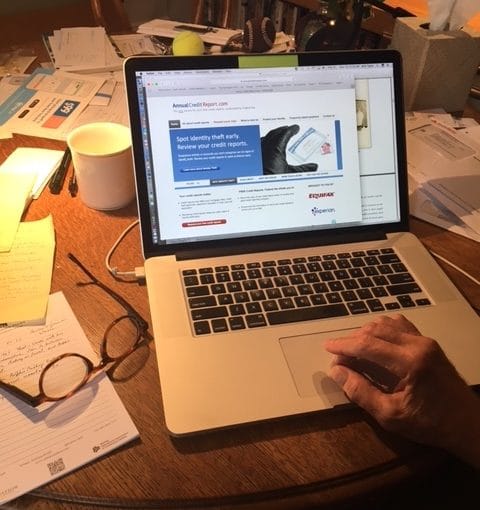

Definitely get your free credit report without paying for extras the credit reporting companies offer. Recently, I got my free credit report from annualcreditreport.com and discovered two fraudulent attempts to get credit in my name. Someone tried to open a Lord & Taylor account, and maybe the same someone tried open a Kohl’s account using my information. In both cases, the card would come through Capital One and Capital One was making the inquiries.

In the process of getting this straightened out, I discovered how easy it is to fall for marketing pitches from the crediting reporting bureaus that may lead you to spend money needlessly. You may find it more difficult to get your credit report online after the Equifax breach.

Remember, you can get your credit report free, three times a year, from Experian, Equifax and TransUnion. But they also try to sell you other things.

The fraud appeared on my Equifax and Experian credit reports. I called Equifax first to put a fraud alert on my account and found myself listening to offers for “an insight score” and a “risk score.” The recorded message said you a pay fee of $11.50 and then $7.95 for the score. Even though the disclaimer in the recording said, “Third parties use many different types of credit scores and will not use your Equifax score to assess creditworthiness,” I was worried about my credit score because of the attempted fraud, so this would have been tempting if I didn’t know that you don’t need these scores.

ConsumerMojo.com reported that the Consumer Financial Protection Bureau (CFPB) found “the credit scores Equifax sells to consumers are not the same scores used by lenders or other commercial users for credit decisions . . .”

In fact, the CFPB ordered Equifax to pay $3.6 million in restitution to consumers for deceiving them about the value of buying these scores. As part of the same ruling, TransUnion had to pay a whopping $13.9 million for the bad practices.

In another action involving marketing of worthless scores, the CFPB fined Experian $3 million.

Oddly enough, I found Experian much easier to deal with than Equifax. When I called, I got through to a polite and helpful human being who placed a fraud alert on my Experian credit report and said the notice would go to the other credit bureaus.

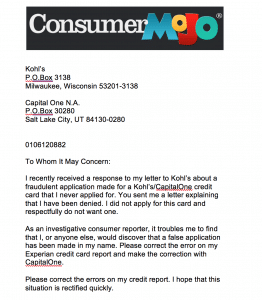

But I didn’t stop there. I also wrote separate letters for each fraudulent inquiry to the credit bureaus, Capital One and the stores involved. I kept copies of everything, just in case.

Yes. This took time. And yes, I didn’t want to do it. But I also didn’t want someone opening a fake account in my name and I didn’t want any negative marks on my credit reports. The mark on your permanent record sounds like a fear from elementary school, and in a way it is.

Every inquiry about opening a credit account can lower your credit score. That’s why it’s important to make sure the information on your credit report accurately reflects your financial history.

Weeks later I received letters from all of the credit bureaus, Capital One, Kohl’s and Lord & Taylor acknowledging that the applications for credit were frauds and that they would take the inquiries off my credit report.

For now, I consider it case closed. But next year, I will check again.

Be aware you might have trouble getting your credit report online after the Equifax data hack and you can find out why and what to do here.