Consumers apparently no longer have a friend in the Democratic chairwoman, Florida Representative Debbie Wasserman Schultz. Schultz co-sponsored legislation aimed at reducing the power of the Consumer Financial Protection Bureau (CFPB) to rein in abusive payday lenders.

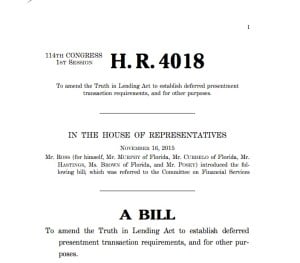

The Huffington Post first reported the story. But a wade through the dense language of congressional legislation reveals that HR 4018, a bill to “amend the truth-in-lending law,” would let weak state regulations override any new, tough regulations proposed by the CFPB. It would also delay new regulations to curb the worst abuses in payday lending.

The Consumer Financial Protection Bureau plans to introduce the regulations sometime in 2016. But Republicans and banking lobbyists have lined up to block it. The Wasserman Schultz endorsement of the legislation seems to have come as a surprise.

Often, people who live from paycheck to paycheck and need cash quickly resort to a payday lender without realizing the consequences. In some cases, lenders charge 400 to 600 percent interest and it becomes very difficult for borrowers to pay off those loans.

A report by the Center For Responsible Lending found that a quarter of the people who borrowed money this way are on Social Security and took out an average of 19 loans.

Consumer groups including the Center for Responsible Lending, the Consumer Federation of America, the NAACP, the Southern Poverty Law Center and the National Consumer Law Center wrote letters to Congress opposing the legislation.

So why Wasserman Schultz and six other Democrats would sign on to the bill remains a mystery.

Hint: Follow the money/contributors to her campaign.