If you find yourself frustrated trying to straighten out mistakes on your credit report, you have a lot of company. Credit reporting companies continue to generate complaints to the Consumer Financial Protection Bureau (CFPB).

The CFPB’s latest monthly report found that 77 percent of consumer complaints involve difficulty removing incorrect information from credit reports.

CFPB Director Richard Cordray said, “Credit reports are the foundation of consumers’ financial lives. We will continue to work to ensure that credit report disputes are investigated, errors are fixed, and consumers are treated fairly.”

What’s happening now seems far from fair. People complain that debts appear that have already been paid, or that they don’t owe debts that appear on credit reports compiled by the three big credit bureaus: Equifax, Experian and TransUnion. They say that when they try to straighten things out, customer service representatives are unhelpful.

In addition, smaller specialty companies that provide background reports and screening for employment and information to property owners about renters also make it difficult for consumers to fix or erase errors.

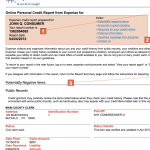

WHAT’S ON YOUR CREDIT REPORT?

WHAT’S ON YOUR CREDIT REPORT?

- Your credit report is a history of your financial life. It has your bill paying history. It lists and shows:

- The credit cards you have, and your payment rate.

- The loans you have, or had, and your loan payment history.

- Your mortgage and your mortgage payments.

- Student loans you have or had, and the way you repay them.

- Judgments or liens against you.

- Alimony or child support payments and how you pay.

- Money you may owe a doctor or healthcare provider.

- Money you may owe a hospital.

- Your outstanding parking ticket fines.

- Whether you’ve been sued.

- Whether you’ve been arrested.

The list will include all of your debts and financial activity and anything to do with your money.

It is unlikely to include local retailers, gasoline credit card companies and landlords with just one or two properties.

Inaccurate Information

If there is a mistake, you must dispute it. You do this by sending letters with proof — your cancelled checks, credit card receipts or other proof that you have paid a bill.

Experian-1-888-397-3742 www.experian.com

TransUnion-1-800-916-8800 www.transunion.com

Equifax-1-800-685-1111 www.equifax.com

The Federal Trade Commission created a sample letter.

Or, you can use our version:

SAMPLE LETTER TO CREDIT BUREAU

Date

Your Name

Your Address,

City, State, Zip Code

Complaint Department

Name of Company

Address

City, State, Zip Code

Dear Sir or Madam:

I am disputing the following information in my file. I have circled the items I dispute on the attached copy of the form that I received. This item (s) (List the item or items you’re disputing and the name of the source such as creditors or tax court and identify the type of account- credit card or judgment, etc.) is inaccurate or incomplete. (Describe what is inaccurate or incomplete and why).

I am requesting that the item be removed to correct the information.

Enclosed are copies of my documentation that support my position. (Describe what you enclose: receipts, payment stubs, court records, etc.)

Please reinvestigate this matter (or these matters), and correct or delete the information as soon as possible.

Sincerely,

Your Name Enclosures: List all the documents that you are enclosing. Do not send originals.

Send copies and keep a copy of your letter.

Send the same letter to the creditor with the same documentation.

Send both by certified mail and keep your receipt.

CREDIT REPORTING COMPANIES MUST INVESTIGATE

Credit reporting companies must investigate within 30 days of receiving your letter. They also must send your dispute and your information to the company or organization involved.

That company is required to investigate and report back to the credit bureau.

If they find that you are right, the information must be corrected on your credit reports by all three reporting companies.

The credit reporting companies must give you the results in writing and a free copy of your updated credit report.

If a company refuses to correct what you claim is an error, you can request that credit reporting bureau keep a copy of your statement in your file.

Because of the persistent problems getting credit report errors straightened out, the CFPB asks that you file a complaint with them if you don’t get what you need: Consumer Financial Protection Bureau (CFPB).