The Trump administration claims to represent “forgotten Americans.” And certainly, millions who say they feel forgotten voted for Trump. But actions by Republicans, Trump’s consumer policies and the rollback of protections created during the past ten years will end up hurting forgotten Americans and millions of others who take those protections for granted.

Janet Yellen, Chair of the Federal Reserve said on the P.B.S NewsHour, “There are some in Congress who would roll back regulations and that could be dangerous.”

A few of the latest examples include

Health Insurance

The Health and Human Services (HHS) Secretary Alex Azar approved a work requirement for adults in Indiana who qualify for Medicaid.

What about people who can’t work? The same approval was given to Kentucky. In addition, HHS okayed a so-called “lock-out” plan for Indiana that would knock people off the Medicaid rolls if they don’t file paperwork on time or miss a premium payment. They’ll have to wait six months to get Medicaid again.

Joan Alker with the Georgetown University Health Policy Institute Center for Children and Families says, “This is a forced period of uninsurance, which penalizes people for missing a premium payment or a paperwork deadline for coverage renewal.” Tens of thousands of people are likely to find themselves without coverage. Alker says, “Some of these folks may no longer need Medicaid, but for those who do, it will be very hard to get back on – resulting in gaps in coverage.”

The attempt to gut the Consumer Financial Protection Bureau (CFPB), which has instituted anti-fraud rules, sued big financial institutions and corrected swindles by getting money back for consumers.

The Financial Services Committee of the U.S. House of Representatives voted to give the credit bureaus a nice gift.

They seem to have forgotten that consumer complaints about the Equifax, Experian and TransUnion top the lists of consumer watchdogs, including ConsumerMojo.com. They also seem to have forgotten the Equifax data breach that compromised the personal information of millions.

So now, they propose a law that would override state laws that require consumer consent for credit bureaus to get information from landlords, housing authorities and utilities.

Forty consumer advocacy and civil rights groups opposed the bill. But it passed anyway. It will go to the full House and if it passes, then the Senate.

Chi Chi Wu with the National Consumer Law Center says, “We hope that members of Congress remember their outrage against Equifax from just a few months ago as they vote on a bill that only benefits the credit bureaus.”

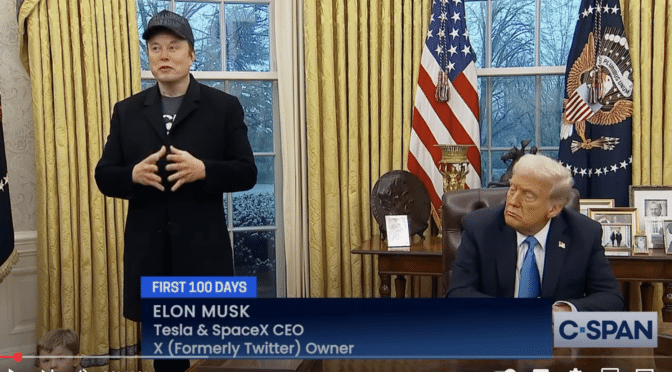

Consumer Financial Protection Bureau

A federal appeals court in Washington, D.C., upheld the structure and independence of the Consumer Financial Protection Bureau (CFP), which Trump and his team want to gut.

The court ruled that the director of the bureau can remain independent of the president, since that was the intent of Congress when it created the independent watchdog. Congress does not approve its budget. The money comes from the Federal Reserve.

Nevertheless, recently Trump’s budget director and acting head of the CFPB asked for a zero budget for the bureau.

We’ll continue to add to our list.